FED: CTF Highlights Government Gouging on Gas Tax Honesty Day

Sign our Gas Tax Petition / See more media and photos on this event

OTTAWA: The Canadian Taxpayers Federation (CTF) today launched its 12th Annual Gas Tax Day with press conferences in Vancouver, Calgary and Ottawa. The CTF is once again highlighting the hidden and growing level of taxes on gasoline in its latest Gas Tax Honesty report.

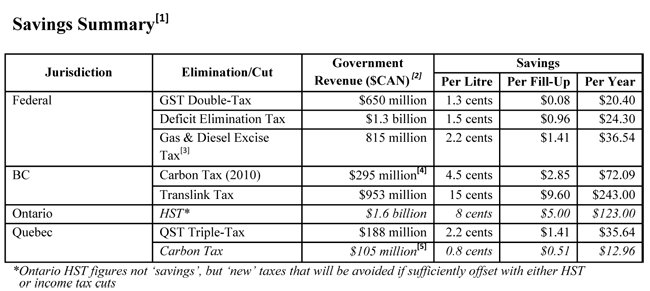

The CTF estimates that the average two-car family will pay $1,095/year in gas taxes in 2010, and that the average pump price will be$1.04/litre, of which 32 per cent - or 34 cents – will be paid in taxes.

High taxes at the pump can be attributed to:

- Federal and provincial excise taxes, averaging 25 cents/litre;

- GST “tax-on-tax,” applying not only to the market price, but to other built-in taxes as well costing 1.3 cents/litre; and

- Quebec Sales Tax (QST) “tax-on-tax-on-tax,” applying to the market price, built-in taxes and the GST at a cost of 2.2 cents/litre.

In addition to already high taxes, many Canadians also face increases this year at the pump in the form of:

- The coming Harmonized Sales Tax (HST) in Ontario, adding 8 cents/litre and $1.6 billion in new revenue; and

- BC’s steadily increasing Carbon Tax, rising to 4.5 cents/litre.

CTF federal director Kevin Gaudet took aim, stating that, “One-third of the cost of filling up the family car goes straight to the government. That means that for an average family with two mid-sized cars, they are shelling out more than $1,000 a year to the government for the privilege of filling-up the tank, in addition to the actual cost of gas itself.”

Regarding tax changes coming into effect on July 1st, Gaudet added, “If all Canadians weren’t already being taken for a ride by high gas taxes, Ontarians and British Columbians face significant increases this year in the form of the HST and carbon taxes. Each litre of gasoline in Ontario will cost an additional 8 cents with the HST, and each litre in BC cost a continually increasing 4.5 cents on account of its needless carbon tax.”